Buying a Vacation Home in Gulf Shores AL

Buying a Vacation Home in Gulf Shores AL: A Guide to Considerations

Buying a vacation home in Gulf Shores, Alabama, can be an excellent investment opportunity for those looking for a second home or a rental property.

Gulf Shores is a popular tourist destination known for its beautiful beaches, warm climate, and vibrant culture. However, before making a purchase, there are several factors to consider to ensure that you make the right investment decision.

Understanding the Gulf Shores real estate market is crucial when buying a vacation home. Gulf Shores has a diverse real estate market, with a range of properties available at varying prices.

It is essential to have a good understanding of the market trends, property values, and rental rates in the area to make an informed decision. Additionally, working with a reputable real estate agent who has local market knowledge can be beneficial in finding the right property at the right price.

Key Takeaways

- Consider the Gulf Shores real estate market trends and property values before making a purchase.

- Working with a reputable real estate agent can be beneficial in finding the right property at the right price.

- Assessing your budget and financing options is crucial when buying a vacation home in Gulf Shores.

Understanding Gulf Shores Real Estate Market

Buying a vacation home in Gulf Shores, AL can be a great investment, but it's important to understand the local real estate market before making a purchase. Here are some key factors to consider:

Home Prices

According to Redfin, the median home price in Gulf Shores was $483K in February 2024, up 13.6% from the previous year. It's important to note that home prices can vary depending on the location, size, and condition of the property.

As such, it's important to work with a local real estate agent who can provide insight into the market and help you find a property that fits your budget and needs.

Rental Income Potential

One of the main benefits of owning a vacation home in Gulf Shores is the potential to generate rental income. The median home value for properties in Gulf Shores is just under $470,000, while in Orange Beach it's around $705,000. As interest in these areas continues to grow, the sooner you can secure your Orange Beach investment property in these hot markets, the better!

Seasonal Demand

Gulf Shores is a popular tourist destination, which means that seasonal demand can have a significant impact on the local real estate market. During peak tourist season, rental rates may be higher and properties may sell more quickly.

However, during the off-season, rental income may be lower and it may take longer to sell a property. It's important to consider the potential impact of seasonal demand when making a purchase.

Property Management

Owning a vacation home in Gulf Shores may require hiring a property manager to handle maintenance, repairs, and rental bookings. It's important to factor in the cost of property management when considering the potential rental income and overall expenses associated with owning a vacation home in Gulf Shores.

By understanding the Gulf Shores real estate market, you can make an informed decision when buying a vacation home in this popular tourist destination.

Benefits of Buying a Vacation Home in Gulf Shores

Gulf Shores, Alabama, is a popular vacation destination that attracts millions of visitors every year. It is also a great place to buy a vacation home. Here are some of the benefits of owning a vacation home in Gulf Shores:

1. A Home Away from Home

Owning a vacation home in Gulf Shores means having a home away from home. You can escape to your own private oasis whenever you want, without worrying about booking a hotel or rental property. You can personalize the space to your liking and make it feel like home.

2. Rental Income

If you're not using your vacation home in Gulf Shores all the time, you can rent it out to vacationers. Gulf Shores is a popular vacation destination, which means there is high demand for short-term rentals. By renting out your vacation home, you can earn extra income to help cover the costs of ownership.

3. Appreciation in Value

Real estate in Gulf Shores has been appreciating in value over the years, which means that your vacation home could be a good investment. If you decide to sell your vacation home in the future, you could potentially make a profit.

4. Tax Benefits

Owning a vacation home in Gulf Shores comes with tax benefits. You can deduct mortgage interest, property taxes, and other expenses related to owning a vacation home on your tax return. Consult with a tax professional for more information on the tax benefits of owning a vacation home.

5. Quality of Life

Gulf Shores is a beautiful coastal town with a laid-back lifestyle. Owning a vacation home in Gulf Shores means having access to beautiful beaches, great restaurants, and plenty of outdoor activities. It's a great place to relax and unwind, and it can improve your overall quality of life.

Assessing Your Budget and Financing Options

Buying a vacation home in Gulf Shores, AL is a significant investment, and it's essential to assess your budget and financing options before making a purchase. The first step is to determine how much you can afford to spend on a vacation home.

This will depend on your income, debt-to-income ratio, credit score, and down payment.

One option for financing a vacation home is a conventional mortgage. A conventional mortgage typically requires a down payment of 20% or more, and the interest rates may be higher than those for primary residences.

However, a conventional mortgage may offer more flexibility in terms of repayment options and loan terms.

Another option is a vacation home loan, which is specifically designed for second homes. Vacation home loans may require a lower down payment than conventional mortgages, but the interest rates may be higher.

It's essential to compare the terms and rates of different lenders to find the best option for your financial situation.

It's also important to consider the ongoing costs of owning a vacation home, such as property taxes, insurance, maintenance, and utilities. These expenses can add up quickly, and it's essential to budget for them when assessing your financing options.

Overall, buying a vacation home in Gulf Shores, AL can be a great investment, but it's crucial to assess your budget and financing options carefully. By taking the time to research your options and budget for ongoing expenses, you can make an informed decision that meets your financial goals and lifestyle needs.

Choosing the Right Location in Gulf Shores

When it comes to buying a vacation home in Gulf Shores, choosing the right location is crucial. The location you choose will affect your overall experience and the value of your investment. Here are some factors to consider when choosing the right location in Gulf Shores.

Proximity to the Beach

One of the main reasons people buy vacation homes in Gulf Shores is to be close to the beach. If you want to be within walking distance of the beach, you should consider buying a property in the West Beach or Gulf Shores East neighborhoods.

If you don't mind driving or taking a short bike ride to the beach, you may want to consider other neighborhoods that are a bit further away.

Neighborhood Amenities

In addition to proximity to the beach, you should also consider the amenities offered in the neighborhood. Some neighborhoods have community pools, tennis courts, and other amenities that can make your vacation more enjoyable. You should also consider the proximity to restaurants, shopping, and other attractions when choosing a location.

Safety and Community

Finally, you should consider the safety and community feel of the neighborhood. Gulf Shores is generally a safe place to live and visit, but some neighborhoods may be safer than others. You should also consider the community feel of the neighborhood. Some neighborhoods are more family-friendly, while others may be more geared towards retirees or young professionals.

Overall, choosing the right location in Gulf Shores is an important decision that should not be taken lightly. By considering factors such as proximity to the beach, neighborhood amenities, and safety and community, you can find the perfect location for your vacation home.

The Importance of a Good Real Estate Agent

Buying a vacation home in Gulf Shores, AL can be a complex process, especially if you are not familiar with the local real estate market. That's why it's important to work with a good real estate agent who has experience in the area and can guide you through the process.

A good real estate agent can help you find the right property that meets your needs and budget. They can also provide valuable information about the local market, including current trends, property values, and investment potential. Additionally, they can negotiate on your behalf to get you the best possible deal.

When choosing a real estate agent, it's important to do your research. Look for someone who has a good reputation in the area and who has experience working with buyers who are looking for vacation homes. You can also ask for referrals from friends and family members who have purchased vacation homes in Gulf Shores.

Once you have found a good real estate agent, it's important to communicate your needs and expectations clearly. Be upfront about your budget, the type of property you are looking for, and any other specific requirements you may have. This will help your agent narrow down the search and find properties that meet your criteria.

In summary, working with a good real estate agent is crucial when buying a vacation home in Gulf Shores, AL. They can provide valuable guidance and help you navigate the local market. Take the time to find the right agent for you and communicate your needs clearly to ensure a successful purchase.

Property Types and Selection Criteria

When considering buying a vacation home in Gulf Shores, AL, one of the first decisions to make is the type of property to purchase. The two main property types are condos and houses. Each has its own advantages and disadvantages, depending on the buyer's preferences and needs.

Condos vs. Houses

Condos are generally less expensive than houses, making them a popular choice for first-time buyers or those on a budget. They also require less maintenance and upkeep, as the condo association is responsible for many of the exterior and landscaping tasks. However, condos often have less privacy than houses, and there may be restrictions on what you can do to the exterior of your unit.

Houses, on the other hand, offer more privacy and space than condos. They also give the owner more control over the property, including the ability to make changes to the exterior and landscaping. However, houses come with more maintenance and upkeep responsibilities, and they are generally more expensive than condos.

New Construction vs. Resale

Another decision to make is whether to buy a new construction or a resale property. New constructions offer the latest features and amenities, and there is less need for repairs and maintenance in the immediate future. However, new constructions are often more expensive than resale properties, and there may be additional costs associated with finishing the property, such as landscaping and installing window treatments.

Resale properties, on the other hand, are often less expensive than new constructions. They also offer more established neighborhoods and mature landscaping. However, resale properties may require more maintenance and repairs, and they may not have the latest features and amenities.

Rental Potential

For those looking to rent out their vacation home, rental potential is an important consideration. Condos often have more rental potential than houses, as they are generally located in areas with more tourist traffic. However, houses can also be rented out, and they may offer more space and amenities for renters.

When considering rental potential, it is important to research local rental rates and occupancy rates. It is also important to consider the costs associated with renting out the property, such as property management fees and marketing expenses.

Overall, the type of property to purchase depends on the buyer's preferences and needs. By considering factors such as privacy, maintenance, and rental potential, buyers can make an informed decision that meets their goals and budget.

Legal and Tax Considerations

Buying a vacation home in Gulf Shores, AL is an exciting investment opportunity, but it's important to consider the legal and tax implications before making a purchase. Here are some key factors to keep in mind:

Property Taxes

Property taxes in Alabama are relatively low compared to other states, but they can still add up over time. The amount you'll pay depends on the value of the property and the location. It's important to research the property tax rate in the area where you're considering buying a vacation home to get an accurate estimate of what you'll owe each year.

Insurance

Insurance is an important consideration when buying a vacation home in Gulf Shores, AL. It's essential to have adequate coverage to protect your investment in case of damage or loss. Homeowner's insurance policies typically cover damage from fire, theft, and natural disasters, but it's important to read the fine print to understand exactly what's covered.

Zoning Laws

Zoning laws in Gulf Shores, AL can be complex, so it's important to understand the regulations before making a purchase. Some areas may have restrictions on short-term rentals, for example, which could affect your ability to rent out your vacation home. It's also important to understand the rules around building and remodeling to avoid any legal issues down the line.

Legal Assistance

Buying a vacation home is a significant investment, so it's recommended to seek legal assistance to ensure the transaction goes smoothly. A real estate attorney can help with the legal paperwork and ensure that you're protected throughout the process. It's also important to have a clear understanding of the terms of the purchase agreement and any contingencies that may apply.

By considering these legal and tax considerations, buyers can make informed decisions when purchasing a vacation home in Gulf Shores, AL.

Home Inspection and Appraisal

Before purchasing a vacation home in Gulf Shores, AL, it is essential to conduct a thorough home inspection and appraisal. A home inspection is an evaluation of the property's condition, including the roof, structure, electrical, and plumbing systems. It is recommended to hire a licensed and experienced home inspector to perform the inspection. The inspector will provide a detailed report of the property's condition, which can help the buyer make an informed decision.

An appraisal is an estimate of the property's value based on its condition, location, and comparable sales in the area. A licensed appraiser will conduct the appraisal and provide a report that includes the property's estimated value.

The appraisal is essential because it determines the maximum amount of financing that the lender will provide. It is important to note that the appraisal is not the same as an inspection.

When considering a vacation home purchase in Gulf Shores, AL, it is recommended to include a contingency clause in the purchase contract that allows the buyer to back out of the deal if the inspection or appraisal reveals any significant issues with the property. This contingency clause can protect the buyer from purchasing a property that requires costly repairs or has a lower value than expected.

In summary, a home inspection and appraisal are crucial steps in the process of purchasing a vacation home in Gulf Shores, AL. They provide valuable information about the property's condition and value and can help the buyer make an informed decision.

Insurance and Risk Management

When buying a vacation home in Gulf Shores, AL, it is important to consider insurance and risk management. Gulf Shores is located on the Gulf of Mexico, which means that it is at risk for hurricanes and flooding. Homeowners insurance is a must-have for any property owner, but it is especially important for those who own property in Gulf Shores.

Hurricane and wind damage are common risks in Gulf Shores, so it is important to make sure that your insurance policy covers these risks. Some insurance companies may require additional coverage for wind damage, such as installing hurricane wind resistive shingles, roof straps, impact-resistant doors, windows, and shutters. It is important to understand the costs of these additional measures and factor them into your budget.

In addition to homeowners insurance, it is important to consider flood insurance. Gulf Shores is located in a flood zone, which means that flood insurance is required by most mortgage lenders. Even if you are not required to have flood insurance, it is still a good idea to have it as a precautionary measure.

Overall, insurance and risk management are important factors to consider when buying a vacation home in Gulf Shores, AL. By understanding the risks and taking the necessary precautions, you can protect your investment and enjoy your vacation home with peace of mind.

Maintenance and Property Management

When considering buying a vacation home in Gulf Shores, AL, it is important to think about maintenance and property management. Vacation homes require regular maintenance to keep them in good condition and to ensure that they are ready for use when you arrive. As a result, it is important to have a plan in place for maintaining your property, especially if you live far away.

One option is to hire a property management company to take care of your vacation home. A property management company will handle everything from cleaning to repairs and will ensure that your home is ready for guests when they arrive. They can also handle rental bookings and ensure that your home is generating income when you are not using it. Our Gulf Shores property management is an example of a company that offers top-notch service and has a reputation for having the best rental properties.

Another option is to take care of maintenance yourself or hire a local maintenance company. This option may be more cost-effective, but it requires more effort on your part. You will need to find reliable contractors for repairs and maintenance, and you will need to coordinate with them when work needs to be done. Additionally, if you plan to rent out your vacation home, you will need to handle bookings and guest relations yourself.

Overall, the decision to hire a property management company or handle maintenance yourself will depend on your personal preferences, budget, and availability. It is important to consider all options and make an informed decision that will ensure that your vacation home is well-maintained and ready for use whenever you need it.

Long-Term Considerations

When buying a vacation home in Gulf Shores, it is important to consider long-term factors that may affect the property's value and your enjoyment of it. Here are some things to keep in mind:

1. Resale Value

While buying a vacation home is primarily for personal use, it is also an investment. Thus, it is essential to consider the property's resale value in the future. A property located in a desirable location, with good amenities and well-maintained, is likely to appreciate in value over time.

2. Maintenance and Upkeep

Owning a vacation home requires regular maintenance and upkeep. Before buying a property, it is essential to factor in the cost of maintenance, repairs, and renovations. It is also crucial to consider whether you are willing to take on these tasks yourself or hire someone to do it for you.

3. Rental Potential

If you plan to rent out your vacation home when you are not using it, it is essential to consider the rental potential of the property. Gulf Shores is a popular vacation destination, and rental properties can generate significant income. However, it is important to research the local rental market, rental regulations, and property management options before making a decision.

4. Weather and Natural Disasters

Gulf Shores is located in a hurricane-prone area, and it is important to consider the potential impact of weather and natural disasters on your vacation home. It is essential to have adequate insurance coverage and prepare for potential weather-related damages.

5. Lifestyle Changes

Finally, it is important to consider how your lifestyle may change over time and how it may affect your use of the vacation home. For example, if you plan to retire in the future, you may want to consider whether the property is suitable for retirement living. Alternatively, if you plan to have children or grandchildren, you may want to consider whether the property is family-friendly and has enough space to accommodate your family.

Frequently Asked Questions

What are the key factors to consider when purchasing a vacation home in Gulf Shores, AL?

When purchasing a vacation home in Gulf Shores, AL, it is important to consider several key factors.

These factors include the location of the property, the condition of the property, the cost of the property, and the potential rental income prospects. Additionally, it is important to consider the property tax implications of buying a second home in Gulf Shores, AL and how the cost of living in Gulf Shores, AL impacts the affordability of a vacation home.

How does Gulf Shores, AL real estate market compare for investment versus other beach towns?

According to recent data, Gulf Shores, AL real estate market is growing and offers good investment opportunities. The median home value in Gulf Shores, AL is higher than the national average, but the potential rental income prospects are also higher than many other beach towns.

Additionally, the cost of living in Gulf Shores, AL is lower than some other popular beach towns, making it a more affordable option for vacation home buyers.

What are the potential rental income prospects for a vacation home in Gulf Shores, AL?

Gulf Shores, AL is a popular vacation destination, which means there is a high demand for vacation rental properties. The potential rental income prospects for a vacation home in Gulf Shores, AL are good, particularly during the peak tourist season.

However, it is important to research the local rental market and understand the costs associated with renting out a vacation home before making a purchase.

What are the property tax implications of buying a second home in Gulf Shores, AL?

When purchasing a second home in Gulf Shores, AL, buyers should be aware of the property tax implications. Property taxes in Gulf Shores, AL are based on the assessed value of the property and can vary depending on the location and condition of the property. Additionally, owning a second home may also impact the buyer's income tax liability.

How does the cost of living in Gulf Shores, AL impact the affordability of a vacation home?

The cost of living in Gulf Shores, AL is lower than some other popular beach towns, which can make it a more affordable option for vacation home buyers.

However, it is still important to consider the overall cost of owning a vacation home, including property taxes, maintenance costs, and potential rental income.

What are the advantages of retiring in Gulf Shores, AL for homeowners?

Gulf Shores, AL offers several advantages for retirees who own a vacation home in the area. These advantages include a mild climate, access to outdoor activities, a lower cost of living, and a relaxed lifestyle. Additionally, owning a vacation home in Gulf Shores, AL can provide a source of rental income during retirement.

Categories

- All Blogs (34)

- Amusement and Entertainment (1)

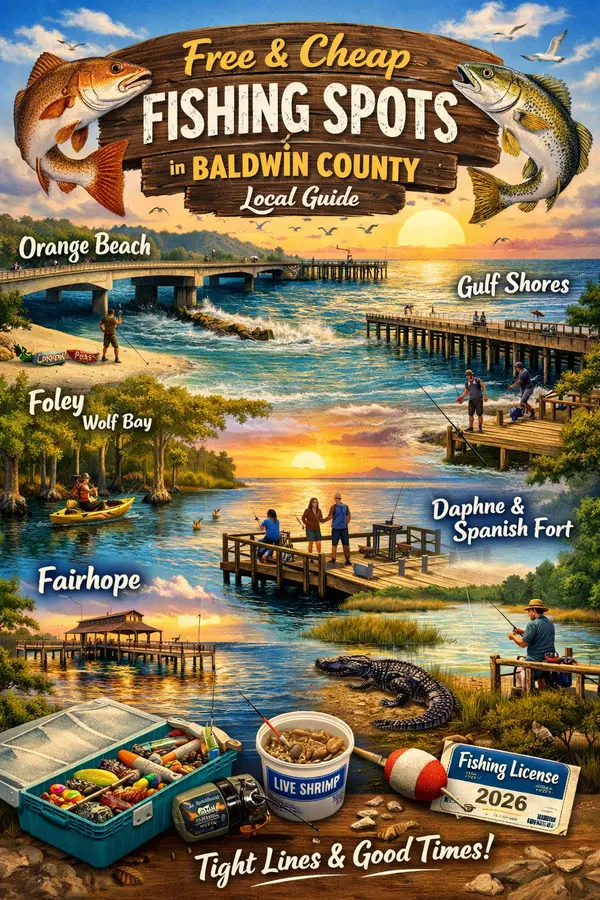

- #BaldwinCountyRealEstate #GulfShoresLiving #FairhopeHomes #SpanishFort #DaphneAL #LowerAlabamaLiving (2)

- 2024 Presidential Election (1)

- Affordable Living (3)

- Baldwin County News (2)

- Baldwin County Real Estate (3)

- Beaches and Coastal Attractions (1)

- Best Neighborhoods for Snowbirds (2)

- Buying A Vacation Home in AL (3)

- Community and Culture (5)

- Community Events (3)

- Community Spotlights (4)

- Cost of Living in Gulf Shores (4)

- Economic Development (2)

- Family-Friendly Destinations (2)

- Gardens and Nature (1)

- Gulf Shores Neighborhoods (4)

- Gulf Shores VS Near by Cities (1)

- Historical and Cultural Sites (1)

- Housing Market Trends (1)

- Investing (2)

- Living in Gulf Shores AL (8)

- Local Business News (2)

- move to Gulf Shores AL (1)

- Moving to Gulf Shores AL (7)

- Property Taxes (1)

- Pros & Cons (5)

- Real Estate (1)

- Relocating to Gulf Shores AL (10)

- Retiring in Gulf Shores AL (7)

- Sports & Recreation (1)

- Travel & Leisure (2)

Recent Posts